[ad_1]

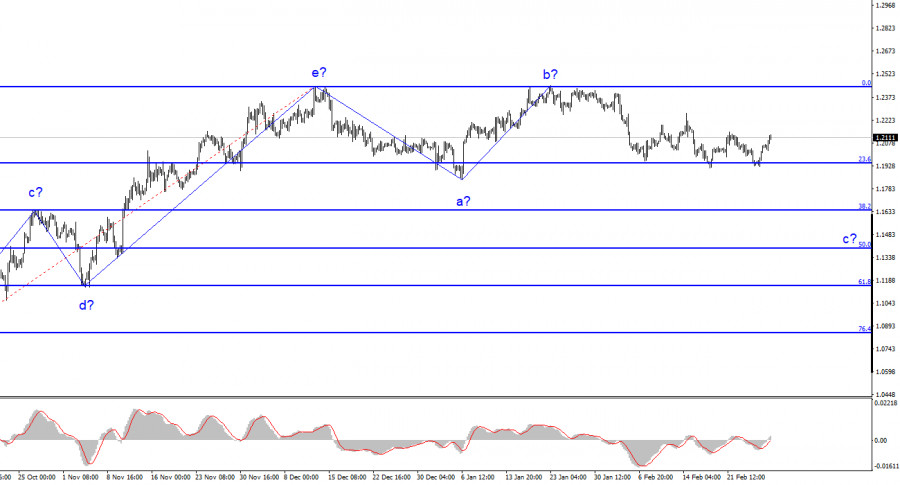

The wave analysis for the pound/dollar pair now appears to be challenging, but it does not call for any clarifications. The wave patterns for the euro and the pound differ somewhat, but both point to a decrease. Our five-wave upward trend part has the pattern a-b-c-d-e and is most likely already finished. I predict that the downward part of the trend has begun and will continue to develop, taking at least a three-wave pattern. Although Wave B appeared to be unnecessarily prolonged, it did not cancel. So, it is presumed that a wave development process has started with a downward part of the trend, the targets of which are situated below wave a’s low. In other words, at least 100–200 points less than the going rate. Although it’s too soon to speculate, I believe wave c may end up being deeper and that the entire downward part of the trend may potentially adopt a five-wave pattern. It took a long time for the pair to start moving quotes away from the peaks reached, although it had been on the verge of restarting the development of an upward trend segment. Since the assumed wave a’s low has not yet been broken, wave c has not yet finished.

Agreement on Northern Ireland is reached between the EU and the UK.

The pound/dollar exchange rate rose by another 90 basis points on Tuesday, after the European Union and the United Kingdom reached a Brexit agreement. The demand for the pound sterling has increased for two days in a row, and because there has been virtually no economic data in the UK and the US these days, we can only assume one thing: the market is raising demand for the pound due to agreements between London and Brussels. I believe that the agreement will do nothing to better the economic status of Northern Ireland or the United Kingdom, let alone the European Union. This is more of a formality that needed to be completed to avoid future disagreements between the EU and the United Kingdom.

Remember that even though the UK has been formally out of the EU for over a year, there have been numerous controversial issues and there has been a chance that the main Brexit agreement may not be implemented. The demands of the European Union for Northern Ireland, which is still a member of it, were not taken into consideration by London. Ireland and Northern Ireland cannot be divided by a physical border because their peoples are brothers. As a result, there were numerous issues with people crossing borders, inspecting commodities, smuggling, and other issues. In actuality, it was a partially legal gateway to and from Europe. The situation on the island will now be more manageable as all the legalities have been completed. But, this event does not have any long-term advantages for the pound. Exchange rates are determined by the market, which is first and foremost determined by inflation or monetary policy factors. While Brexit as a whole is already history, we nevertheless occasionally notice some of its repercussions. The market, however, is unable to lower the demand for the pound as required by the current wave pattern because of these repetitions.

Conclusions in general

The formation of a downward trend section is implied by the wave pattern of the pound/dollar pair. Currently, sales with targets at the level of 1.1508, or 50.0% Fibonacci, might be taken into account. The peaks of waves e and b could be used to place a Stop Loss order. Wave c might be shorter in duration, but for the time being, I anticipate a minimum 300–400 point decline (from current levels).

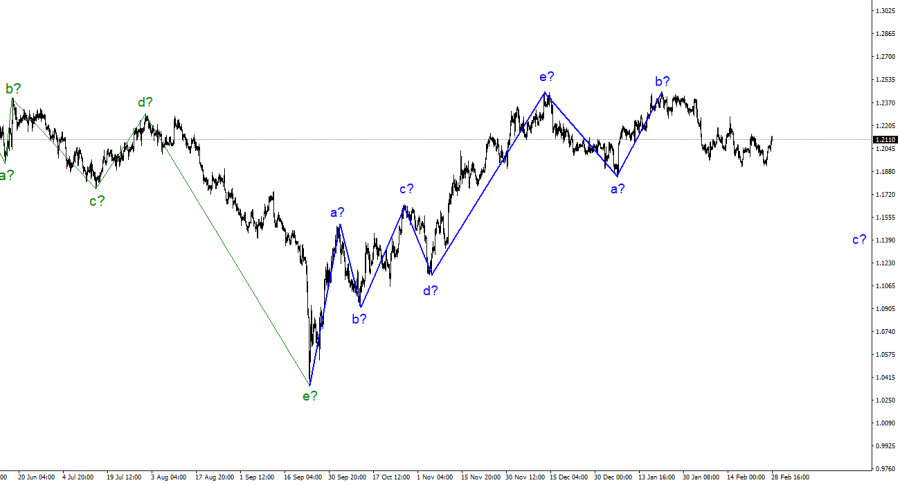

The image resembles that of the euro/dollar pair at higher wave levels, but there are still minor differences. The upward correction part of the trend has now been finished. If this presumption is true, then we must wait for the development of a downward section to continue for at least three waves with the possibility of a decrease in the region of figure 15.

[ad_2]

Source link